Bankrate 401k withdrawal calculator

Nearly 30 of American workers were self-employed in 2019 according to Gallup and the coronavirus pandemic has only accelerated the trend toward. Find out whether your new employer has a defined contribution plan such as a 401k or 403b that allows rollovers from other plansEvaluate the new plans investment options to see whether they fit your investment style.

How To Calculate Debt To Income Ratio

You need to catch up on retirement savings.

. Use the Payment Calculator worksheet the featured image above to create an amortization table based on the auto loan amount annual. A 401k plan can be a great way to invest giving employees a way to grow their savings tax-deferred until retirement. We also have a 401k Savings Calculator designed specifically for estimating the future value of a 401k savings account.

Investors have been on quite a ride since the start of 2020. It can also generate a PDF report. Free calculators for your every need.

Best and worst states for retirement. The Roth IRA allows workers to contribute to a tax-advantaged account let the money grow tax-free and never pay taxes again on withdrawals. How to avoid early withdrawals.

In certain hardship situations the IRS lets you take withdrawals before age 59 12 without a penalty. Unfortunately there are some companies that dont have a 401k plan at. Retirement plan income calculator.

The company also offers payroll insurance human resources and tax services to small business ownersThat makes it appealing to business owners who want a one-stop shop for all their needs. Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future. 72t Calculator by Bankrate.

Unless youre over the age of 59½ youll pay the 10 percent penalty if you wait. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more. If the 401k divorce calculator doesnt scare you off youll need to act quickly if you want the money.

You cant take loans out from old 401K accounts. A Roth IRA offers many benefits to retirement savers. You may take a hardship withdrawal from your 401k if the plan is held by your employer.

Consistent contributors to retirement plans such as a 401k have been rewarded by staying the course through the ups and downs in. This calculator also provides a graph and schedule for each option. Consider your own financial need health and other retirement plans before making the call.

Why We Chose It. Savings in these accounts grow tax-deferred until you withdraw them. Compare rates from lenders to get the best deal.

It provides quite a bit of additional detailed information. Your cash reserves are low. The ranks of self-employed Americans are growing.

Best age to take Social Security. Once youve reached your goal consider investing extra savings either by contributing more through an employer-sponsored plan such as a 401k or 403b or funding a Roth or traditional IRA. When you are age 55 through 59 12 you can begin to withdraw from your 401 k without penalty.

If your new employer doesnt have a retirement plan or if the portfolio options arent appealing consider staying in your old. Taking a withdrawal from your traditional 401k should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS plus a 10 percent early withdrawal. ADP is a business services company that does more than just provide 401k services.

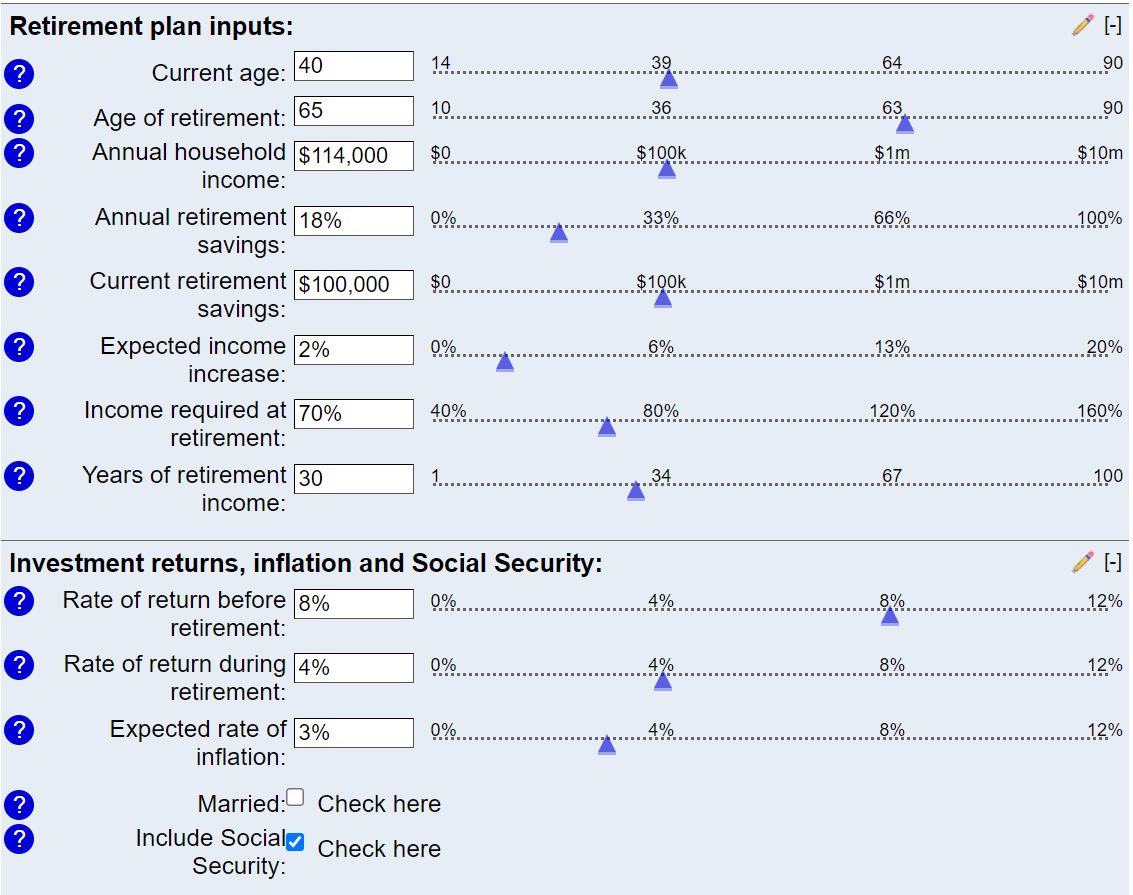

You dont want to end. Try the Annuity Calculator if you are trying to figure out how much you may need at retirement. This calculator has slide bars that allow you to easily adjust the inputs but its best feature is the text below the graph.

You can also shave 025 percent off your rate when you set up automatic payments from a Bank of America checking or savings account up to 075 percent off for making an initial withdrawal and up. Use the Auto Loan Calculator worksheet to calculate the amount you will need to finance based on the sales price of the car destination charge fees sales tax down payment cash rebate and trade-in value of an older auto. If you are comfortable with Excel you can also use our Savings Calculator as a template and customize it to suit your own personal situation.

And an NUA may be subject to a 10 percent early withdrawal tax if you move funds prior to age 59 12. Bankrate LLC NMLS ID. Typically a delay in collecting Social Security payments pays off for recipients.

If you completed a retirement plan and find you arent contributing enough to your 401k IRA or other retirement accounts increasing those contributions should probably be your top priority. Find news and advice on personal auto and student loans.

Budgeting For Beginners Learning Course From Financial Experts Bankrate

Citibank Savings Account Rates Bankrate

Inheritance Tax Here S Who Pays And In Which States Bankrate

Savings Calculator Bankrate Cheap Sale 48 Off Aarav Co

What Is Net Income Definition How To Calculate It Bankrate

7 Best Free Online 401k Calculator Websites

Discover Bank Cd Rates Bankrate

The Best Retirement Calculators 2022 Can You Retire Early Part Time Money

Retirement Planning 101 The Complete Guide To Saving For Retirement

Debt Management Learning Course From Financial Experts Bankrate

Home Refinance Learning Course From Financial Experts Bankrate

Ira Minimum Distribution Calculator Required Minimum Distribution Ira Distribution

Investing For Beginners Learning Course From Financial Experts Bankrate

What Is The Best Roth Ira Calculator District Capital Management

Savings Calculator Bankrate Cheap Sale 48 Off Aarav Co

Credit Cards Find The Right Offer For You Apply Online Bankrate

The Best In Investing In 2022 Bankrate Awards